pay personal property tax richmond va

The assessed value is multiplied by the appropriate tax rate. Back to Top Pay Using Department Ticket Number Pay Using Social Security Number Pay Using Account Number.

2700 Monument Ave Richmond Va 23220 Realtor Com

The personal property tax rate is determined annually by the City Council and recorded in.

. Call our automated system Teleplan available 24 hours a day at 8044405100. The current rate is 350 per 100 of assessed value. For Real Estate Tax Payments you will need your 5 digit Account Number and your Bill Number.

To contact customer service regarding questions about your false alarm bill call toll-free 1-877-893-5267. Prepayments are accepted if you would like to make payments in advance of the due date for real estate and personal property taxes. Answer the following questions to determine if your vehicle qualifies for personal property tax relief.

To mail your tax payment send it to the following address. To visit the site register your alarm or make a payment visit Cry Wolf. Mon-Fri 8am - 6pm.

You can choose the option of Post as Guest below to post anonymously. Make a Payment Bills Pay bills or set up a payment plan for all individual and business taxes Individual Taxes Make tax due estimated tax and extension payments. Public Information Advisory - May 2 2022 Combined Sewer and Drinking Water Plant Facilities Tour.

Distributors do not pay tax on items purchased for resale. Informal Formal Richmond City Council Meetings - May 9 2022 at 400 pm. The property owner must be at least 65 years of age or determined to be permanently or totally disabled by December 31 st of the year preceding the year for which assistance in required.

Learn how to get your shot at VaccinateVirginiagov or call 1-877-VAX-IN-VA. The total tax is 5 percent 4 percent state and 1 percent local A seller is subject to a sales tax on gross receipts derived from retail sales or leases of taxable tangible personal property. Please call the office for details 804-333-3555.

We will try to answer them soon. May 6 2022 0756 PM EDT. Pay online through Paymentus or.

Traduccion disponible en tu idioma. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. Personal Property Registration Form An ANNUAL filing is required on all.

Virginia Department of Taxation PO. Property value 100000 Property Value 100 1000 1000 x 120 tax rate 1200 real estate tax. Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to.

The assessment on your personal property account can be obtained by calling the Finance Department Revenue Division at 804 501-4263. WRIC Henrico County has announced plans to slash this years personal property. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established by Richmond City Council.

City Code - Sec. WRIC Personal property taxes for those living in Chesterfield are due by June 6 and the countys Treasurers Office wants. The personal property tax is calculated by multiplying the assessed value by the tax rate.

Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date. Personal Property Taxes are billed once a year with a December 5 th due date. The City Assessor determines the FMV of over 70000 real property parcels each year.

For Personal Property Tax Payments you will need your 5 Digit Account Number. Revised Public Information Advisory - FY 2023 Council Budget Schedule. You can also review and manage your payment plan online.

Other Useful Sources of Information Regarding False Alarm Fees. Qualifying farmers fishermen and merchant seamen should use the 760-PFF voucher. 10 down payment is required.

On the Pay Personal Property Taxes Online Screen press the button containing your preferred method for finding tax information. The Treasurers Office has several ways you can pay. 2 days agoHenrico County leaders say theyll be the first in Virginia to use an amended law that becomes effective July 1 which allows localities to give.

20 down payment is required. TAX RELIEF FOR THE ELDERLY AND DISABLED - REAL ESTATE. Box 1478 Richmond VA 23218-1478 Include your Social Security number and the tax period for the payment on the check.

Language translation available TTY users dial 7-1-1. My office has used the same assessment methodology for at least 35 years. As of December 31 st of the year preceding the tax year for which assistance is requested the.

Pay Personal Property Taxes Offered by City of Richmond Virginia 804646-7000 PAY NOW Pay Personal Property Taxes in the City of Richmond Virginia using this service AD AD Community QA You can ask any questions related to this service here. For additional information visit Department of Finance website or call 804 501-4263. Call our Collections Department at 8043678045 during regular business hours to speak with a representative.

Manufacturers do not pay tax on purchases used for production. Call 18333391307 18333391307 Individual income tax bills - choose Individual Bill Payments Business tax bills - choose Business Bill Payments Have your 5-digit bill number and Virginia Tax account number ready. May 6 2022 0302 PM EDT.

Department Ticket Number Social Security Number or Account Number. Enterate como conseguir tu vacuna VaccinateVirginiagov o llamando al 1-877-829-4682 de Lunes-Viernes 8am a 6pm. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. A service fee is added to each payment you make with your card.

4 hours agoFor example the current personal property tax rates in Henrico Hanover and Chesterfield counties for vehicles are 350 357 and 360 respectively per 100 of assessed value. How is the personal property tax calculated. Call 1-888-272-9829 Press 3 for property tax and all other payments Enter Jurisdiction Code 9010 You must call the Treasurers Office to obtain the amount due.

The Commissioner of the Revenue is responsible for assessing personal property taxes VA Code Sec 581-3100-31231. Is more than 50 of the vehicles annual mileage used as a business. Richmond County Treasurers Office.

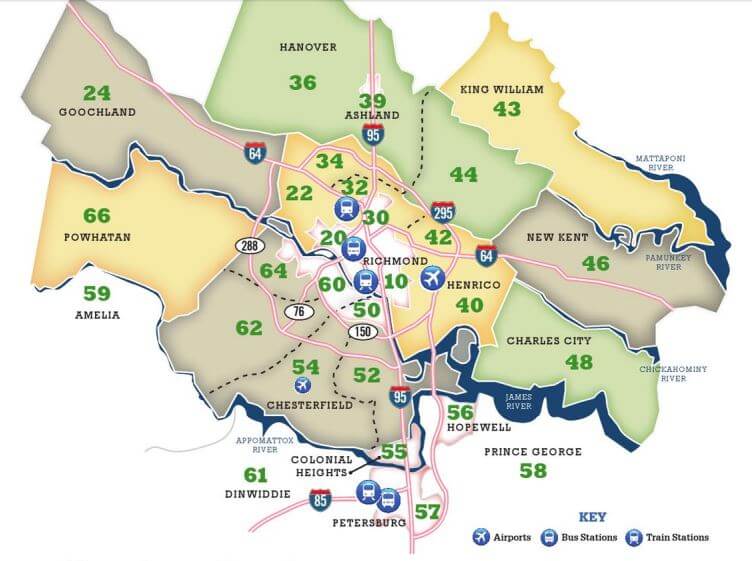

Guide To Richmond Area Mls Real Estate Zones Mr Williamsburg

Richmond Va Metro Area June 2021 Real Estate Market Update In 2021 Real Estate Marketing Real Estate First Home Buyer

Communities Neighborhoods In Richmond Virginia Why Richmond Is Awesome

1713 W Moore St Richmond Va 23220 Mls 2201976 Redfin

4515 Augusta Ave Richmond Va 23230 Realtor Com

2322 R St Richmond Va 23223 Realtor Com

802 Seneca Rd Richmond Va 23226 Realtor Com

417 S Davis Ave Richmond Va 23220 Realtor Com

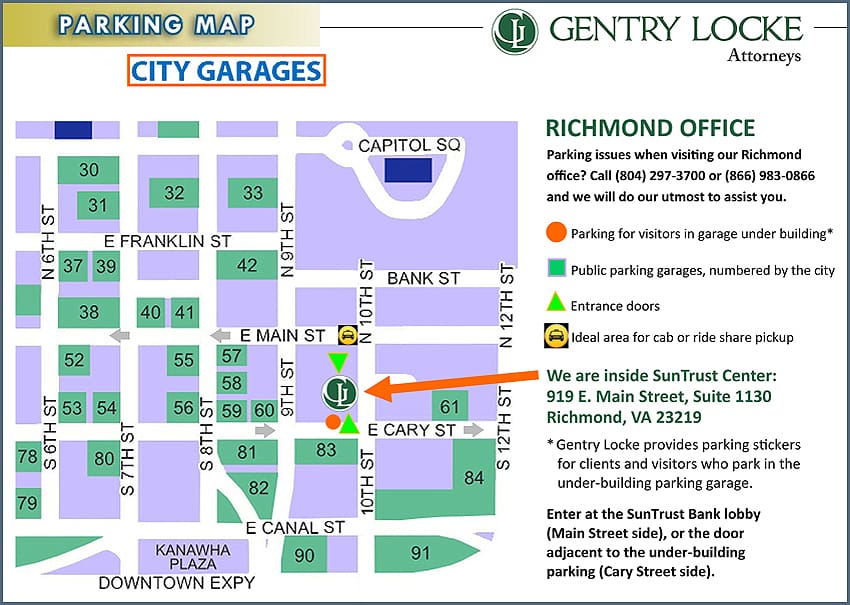

Visiting Our Richmond Office Gentry Locke Attorneys

1713 W Moore St Richmond Va 23220 Mls 2201976 Redfin

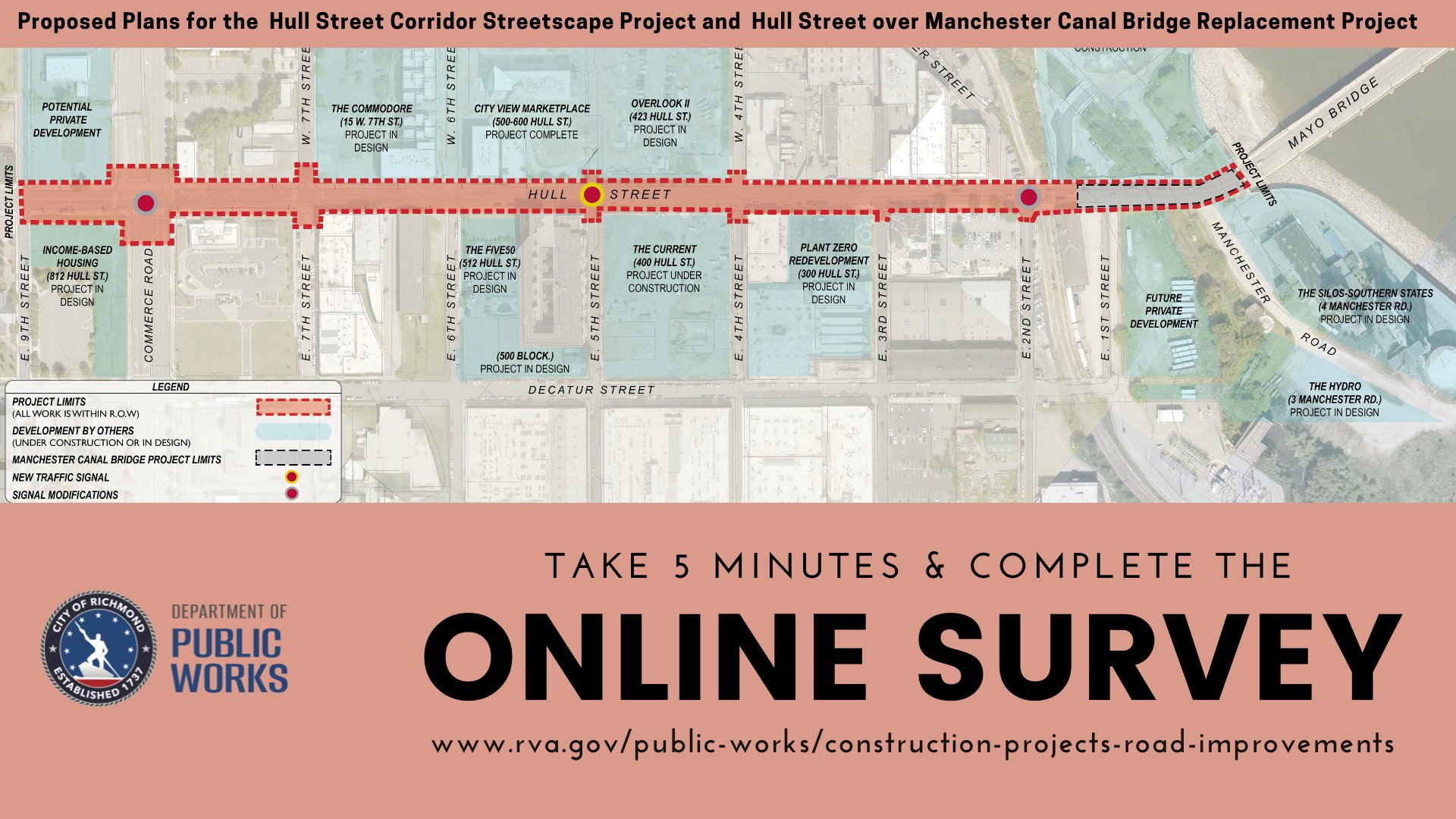

Richmond Va Dpw Dpw Richmondva Twitter

Communities Neighborhoods In Richmond Virginia Why Richmond Is Awesome

Richmond Va Dpw Dpw Richmondva Twitter

2031 Monument Ave Richmond Va 23220 Mls 2205854 Redfin

1725 Creek Bottom Way Richmond Va 23236 Realtor Com